A guide to active and passive investing Investment funds can be broadly split into two categories – active and passive. And while

Super and tax – what’s changing on 1 July 2024

They say nothing is certain in life except two things – death and taxes. Australians can probably add a third – the knowledge that come the end of financial year, the rules around superannuation and taxation will inevitably change.

How to reduce your mortgage interest rate and fees

With interest rates continuing to rise, reducing your mortgage interest rate can be a great way to save money so you’re not out of pocket and can keep or invest more of what you earn.

How debt can help you build long term wealth

Contrary to what some people may think, debt can help you build your wealth – especially if the debt is used responsibly with a clear plan and objective.

Commonly Asked Questions – retirement planning

Retirement is a major milestone in life, representing the end of years of hard work and dedication. It's a time to enjoy the freedom to pursue your passions and interests without being tied to a work schedule.

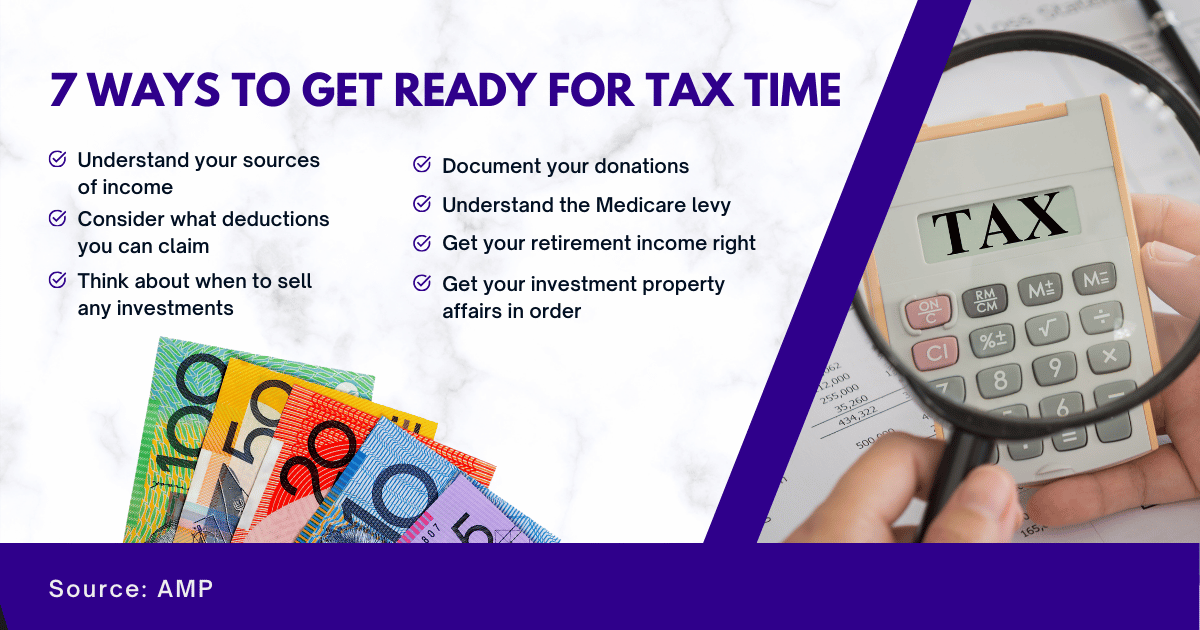

7 ways to get ready for tax time

Here’s a quick checklist to help you prepare for the end of financial year and maximise your tax time benefits.

Social media scams – who’s really following you

Cyber criminals are targeting people based on personal details and preferences – and reeling them in with professional looking follow ups. Find out how to protect yourself.

How women can future proof their wealth

Planning for retirement is a daunting task but it’s too important not to think about – especially for women. Fortunately, there are some small steps women can take today to protect and grow their finances for the future.

Helping your parents financially while saving for retirement

Many people are finding themselves in a situation where they need to provide financial support to their aging parents. Balancing the responsibility of helping your parents financially while saving for your own retirement, is no doubt challenging.

Do you know your Total Superannuation Balance

The total superannuation balance or TSB was a significant change introduced as part of the Government’s superannuation reform package, taking effect on 1 July 2017. However, unlike other changes, such as the pension transfer balance cap, the total superannuation balance has generally been overlooked despite its broad implications.